Learn about Boston Investor Relations including our News & Press Releases, Projects, and Team.

Talk to us

Have questions? Reach out to us directly.

Learn about Boston Investor Relations including our News & Press Releases, Projects, and Team.

About Boston Investor Relations

- Population

- 675,647

- Bond Ratings as of 2022

- Aaa/AAA

- Bonds Outstanding as of 6/30/23

- $1,674,905,000

This is the official investor relations page for the City of Boston. Managed by the city’s Chief Financial Officer and Senior Deputy Treasurer, the City’s Treasury division is responsible for the issuance of all bonds and the City’s investor communications efforts.

About Boston

The City, incorporated as a town in 1630 and as a city in 1822, exists under Chapter 486 of the Acts of 1909 and Chapter 452 of the Acts of 1948 of The Commonwealth of Massachusetts (the “Commonwealth”) which, as amended, constitute the City’s Charter.

The Mayor is the chief executive officer of the City. Mayor Michelle Wu’s term began on November 16, 2021. The Mayor has general supervision of and control over the City’s boards, commissions, officers, and departments. The portion of the City budget covering appropriations for all departments and operations of the City, except the School Department and the Boston Public Health Commission, is prepared under the direction of the Mayor.

The legislative body of the City is the thirteen-member City Council. The City Council enacts ordinances and adopts orders, which the Mayor may either approve or veto. Ordinances and orders, except orders for the borrowing or appropriation of money and the reorganization of City departments, may be enacted by the City Council over the Mayor’s veto by a two-thirds vote. The City Council may reject or reduce a budget submitted to it by the Mayor, but the City Council may not increase a budget.

Image Gallery

News

Mayor Michelle Wu today announced that Boston has again maintained its triple-A bond ratings and stable outlook, as assigned by Moody’s Investor Service and S&P Global Ratings, in advance of its upcoming 2025 bond sale. Since 2014, the City has maintained the top credit rating from both rating agencies. The agencies’ affirmations of Boston’s strong financial health is a recognition of the City’s strong fiscal management in the wake of uncertain economic times nationally. Mayor Wu’s FY26 budget, filed in April, underscores Boston’s strong fiscal management by enabling Boston to meet its long-term financial obligations while preserving the excellent City services residents and businesses depend on.

“This is the highest possible rating a city can earn and a sign and affirmation that our economic fundamentals are strong and that our local economy is resilient, vibrant, and growing,” said Mayor Michelle Wu. “This rating means we are able to get the best possible rates when we make critical investments in our city’s infrastructure from our schools to our fire stations. As the current federal administration sows economic chaos and targets the industries that Boston relies on, Boston remains determined to fight back.”

According to Moody’s Investors Service, Boston’s Aaa rating reflects what their report called a resilient economy that benefits from “a healthy mix of industries anchored by significant and world-renowned higher education and healthcare institutions.” The report also noted Mayor Wu’s budget proposal and a stable economic outlook for the City in the wake of national uncertainty.

The recent S&P Global Ratings report reflected a similar stable outlook for Boston, noting “that the city’s comprehensive budget framework, combined with proactive management, will enable it to maintain structural balance in the near term, despite significant policy uncertainty.” The analysis noted Boston’s position as an anchor in the region’s larger, robust economy and proactive budget management policies.

“Fiscal discipline is not new to Boston, and this rating action from Moody’s and S&P acknowledges the City’s strong financial position and long-standing fiscal management practices,” said Ashley Groffenberger, Chief Financial Officer. “The City has earned these ratings through years of diligent budget management, which has allowed us to manage through challenging economic cycles and will put us in the best position to manage future uncertainty. I want to thank the dedicated staff of the Finance Cabinet for the work they do every single day to preserve this rating.”

The City of Boston remains in a strong fiscal position due to consistent and responsible budget management that allows the City to routinely return budget surpluses. With over $300 million of federal funds supporting critical City services each year and with likely impacts from federal tariffs and other policy changes to the broader economy, the City is exercising caution in this year’s budget to ensure stability for residents and essential City services. The Fiscal Year 2026 annual operating budget filed by Mayor Wu is $4.8 billion and the five-year 2026-2030 Capital Plan is $4.5 billion. By slowing budget growth, Boston will continue to meet the fixed and long-term financial obligations, deliver for residents, and stay adaptable amidst shifting economic and federal dynamics.

“Boston has yet again secured a AAA bond rating, demonstrating the smart fiscal management of the city, even in challenging times nationwide. We stand out among our peer cities. It demonstrates that we can do the work of shared prosperity - investing in the needs of our residents and neighborhoods equitably while maintaining Boston’s status as a sound investment for investors,” said City Council President Ruthzee Louijeune.

“Thanks to the city’s track record of smart budgeting over several administrations, Boston remains fiscally strong, and these bond ratings are further evidence of that,” said Councilor Brian Worrell (District 4), Chair of the Committee on Ways & Means. “I look forward to ensuring we continue to invest in city services while overseeing our budget to safeguard our residents from higher tax burdens.”

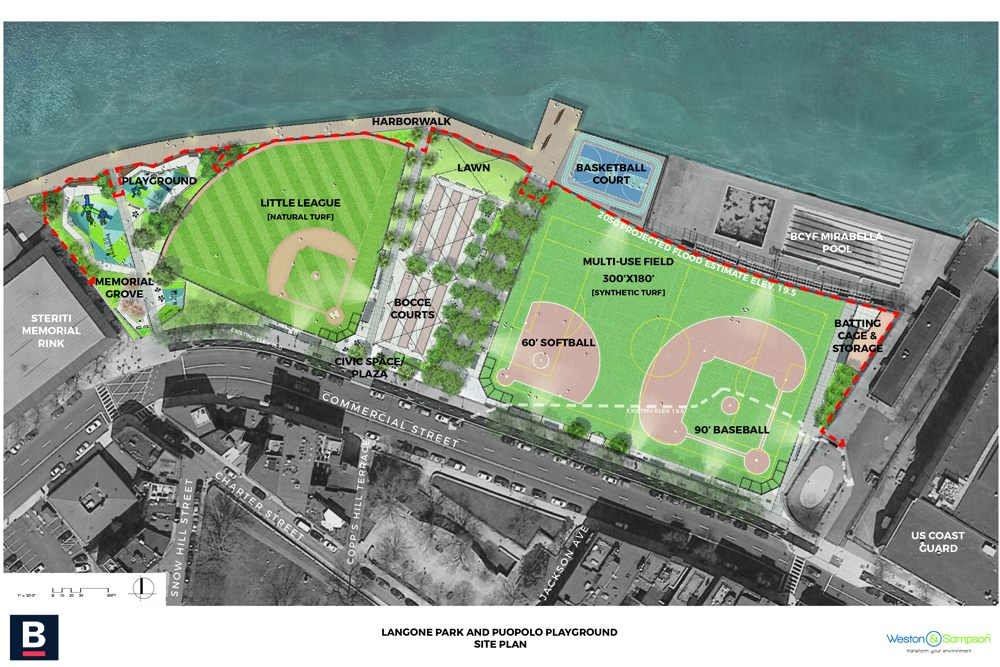

The City typically issues bonds at least once per year and expects to go to market on the sale of its 2025 General Obligation bonds the week of May 19, 2025. The upcoming bond sale is expected to generate $500 million in new funding towards nearly 200 capital projects in the City, including new and renovated schools, major park and playground renovations, new libraries, community centers and pools, energy improvement projects, and other state of good repair and infrastructure projects.

Budget underscores strong fiscal management, stability and constraint to ensure the delivery of City services amidst federal uncertainty.

Mayor Michelle Wu today filed her Fiscal Year 2026 annual operating budget and five-year 2026-2030 Capital Plan. The FY26 budget reflects stability and constraint as the country faces uncertain economic times, with the reduction of long-term vacancies and no new position investments in City departments, modest reductions in non-personnel items, and limited new investments constrained to necessary City services. The FY26 budget has an enhanced focus on enabling Boston to meet its long-term financial obligations while preserving the excellent City services residents and businesses depend on.

The City of Boston remains in a strong fiscal position due to consistent and responsible budget management that allows the City to consistently return budget surpluses. This strong fiscal management is reflected in the City’s AAA bond rating for the past 10 years. With over $300 million of federal funds supporting critical City services each year and with likely impacts from federal tariffs and other policy changes to the broader economy, the City must exercise caution to ensure stability for our communities. The Fiscal Year 2026 annual operating budget filed by Mayor Wu is $4.8 billion and the five-year 2026-2030 Capital Plan is $4.5 billion. City departmental budgetary costs excluding fixed and long-term obligations are expected to grow by 1.7% over FY25 spending, reflecting the cost escalation of maintaining critical service levels. Including non-discretionary costs, this budget grows at the rate of inflation: by 4.4% over FY25.

“Our goal at the city every year is to always present the most responsible budget possible. We are finding ways to provide stability in the face of tremendous economic uncertainty by supporting our local businesses, creating pathways to the jobs that we know are needed and critical, and providing resources wherever we can,” said Mayor Michelle Wu. “This proposed budget affirms Boston as a home for everyone and, in very difficult times, continues to prioritize critical city services. I want to thank Council President Louijeunne and Chair of Ways and Means Worrell for their work to deliver this very first proposed budget in a much more collaborative way. We look forward to continued due diligence and vetting over the next few months.”

“This year’s budget prioritizes meeting our long-term obligations and maintaining excellent city services, while recognizing and adapting to the unpredictable economic climate,” said Chief Financial Officer Ashley Groffenberger. “Because of our stable revenue sources and years of responsible budget management – earning the City a AAA bond rating for over a decade – Boston is well-positioned to meet this moment of economic uncertainty, while ensuring we can fulfill our commitments to employees and residents.”

“Federal funding uncertainty is impacting state and local budgets across the country, making it a significant challenge for cities and states to meet the needs of their residents. Mayor Michelle Wu’s City of Boston budget proposal seeks to comply with the city’s obligations, including the continuation of programs that serve the critical needs of the people of Boston. We commend the Mayor for taking a thoughtful approach to the city’s budget,” said Viviana M. Abreu-Hernández, President of MassBudget. “At MassBudget, we continue to monitor federal funding cuts and their impacts on Massachusetts. This attack on public services means local budgets across the Commonwealth are at risk.”

“Whether public safety, schools, or filling potholes, municipal budgeting is all about providing reliable and essential services for residents who depend on them,” said Adam Chapdelaine, Executive Director & CEO of the Massachusetts Municipal Association. “In a shifting economic landscape and increased federal uncertainty, the City of Boston is taking a thoughtful and responsible approach.”

By slowing budget growth, Boston will continue to meet the fixed and long-term financial obligations, deliver for residents, and stay adaptable amidst shifting economic and federal dynamics.

This year’s budget prioritizes:

Basic City Services

Excellent constituent services is a core value shared by the entire City of Boston. The FY26 budget will see modest growth in the Streets Cabinet of $12.8 million or 6.6%, related to new, improved trash collection contracts that provide additional contracted labor and require more reliable trucks and technology. The Innovation and Technology Cabinet’s budget will grow in FY26 by $4.1 million or 7.7% as they lead efforts in partnership with the Community Engagement Cabinet and all the service delivery departments to build out a new 311 constituent relationship management technology and permitting and licensing systems, improving constituents’ experience reporting issues, requesting services, and obtaining permits. The FY26 budget also includes investments in the Elections Department to help implement necessary operational reforms and improvements.

The Capital Plan includes over $6 million for the implementation of key technology systems. The Plan also invests over $188 million in state of good repair needs for municipal facilities, including community centers, libraries, fire houses, police stations, and City Hall.

In FY26, the Streets Cabinet will continue to improve overall mobility, roadway repairs, and curb management. The Capital Plan will invest over $135 million over the next five years in sidewalk reconstruction, roadway resurfacing, and the construction of ADA compliant curb ramps, ensuring safe, reliable, and accessible transportation for all road users. Traffic calming investments will also continue delivering needed safety improvements across our neighborhoods.

Health and Safety

The City works every day with community partners to maintain Boston as the safest major city in the country. To support continued progress on community safety, Police, Fire and Emergency Medical Services will continue to utilize their cadet programs as a recruiting program for future recruit classes so the first responder workforce is fully staffed and reflects the residents of Boston. In FY26, the youth jobs budget will maintain the City’s record-breaking, robust commitment to youth employment as a benefit to the entire community.

The Boston Public Health Commission will focus on helping those struggling with substance use disorder and homelessness, as well as the general health and well-being of all residents. The Boston Public Health Commission will utilize opioid settlement funds and its operating budget to continue tackling opioid overdoses. Additionally, the Commission will use existing resources to partner with local business organizations to target syringe collection in local business districts. The Age Strong Commission, with strong support from the Mayor and City Council, will leverage their Council on Aging state external funds and operating budget to target reducing social isolation for older adults through increased programming across several neighborhoods. These resources will augment state earmarked funding for senior programming in West Roxbury, increasing programming from two days to three days per week.

Education

Public education represents the largest operational departmental budget, with FY26 budgetary growth of $45.5 million focused on inclusive education, early childhood education, supporting multilingual learners, and providing a high quality educational experience for every student. Newly renovated school buildings reopening in FY26 include the combined Philbrick and Sumner Schools at the new Sarah Roberts Elementary School, the Carter School, and PJ Kennedy Elementary. The FY26-30 Capital Plan invests almost $1.2 billion in BPS facilities, accounting for 27% of the total planned investment. Moreover, 32% of all City bonds, which finance the vast majority of the Capital Plan, are invested in BPS.

Housing Affordability

With robust operating budget investments made in FY25, the Housing and Planning Cabinets continue to target affordability with a focus on housing stability. In the FY25 operating budget, $2 million in one-time seed funding paired with $3 million in American Rescue Plan seed funding was provided to start the Housing Acquisition Fund. The program helped kickstart a public-private revolving loan fund to provide low interest debt, advancing much needed affordable housing preservation. Additionally, in FY25 a supplemental operating budget of $110 million for the Housing Accelerator Program was appropriated with the goal of providing funding in Boston’s approved mixed-use housing projects, lowering the cost of capital to spur construction now, while achieving a return for the City in the long run. Accelerator Program projects must be ready to start construction and be 20% affordable to be considered. Selection will prioritize climate sustainability, positive community impact, and development teams that reflect and represent our communities. Finally, the Acquisition Opportunity Program, funded with a variety of external resources outside of the operating budget, will support mission-driven developers to buy occupied multi-family private housing and make it permanently affordable. Homeowners will have greater access to utility-based incentive programs through the Boston Energy Saver program, which is a part of the Environment, Energy and Open Space cabinet, enabling homeowners to upgrade their heating and cooling systems, saving significant money. Meanwhile, using existing operating funding, the Housing Cabinet will launch a Co-Purchasing Pilot Program to encourage households to combine their purchasing power and buy multi-family homes with 0% interest-deferred loans from the City. The Capital Plan also invests $124 million in partnership with the Boston Housing Authority in the preservation and redevelopment of the Bunker Hill, Mildred Hailey, and Mary Ellen McCormack sites.

“I’m grateful to Mayor Wu for prioritizing programs like the Boston Energy Saver in this budget, working to lower energy costs for our residents. It’s essential to address affordability challenges while not abandoning climate action, even in a time of economic uncertainty,” said Hessann Farooqi of the Boston Climate Action Network.

“I’m really pleased to see that the City’s budget increases only modestly, leaves the rainy day fund in place, maintains critical services, and continues to lead the country with proactive initiatives for affordable housing development, for acquisition of apartment buildings before rents skyrocket, and to help extended families buy triple-deckers. I am grateful to Mayor Wu for proposing a responsible budget that prioritizes public safety, schools, and youth jobs while helping families build wealth,” said Bart Mitchell, President and Chief Executive Officer of The Community Builders (TCB), the country’s largest nonprofit developer of mixed-income housing and that recently moved their 135 person headquarters office to downtown Boston.

The $4.6 billion FY 2025 Operating Budget and $4.7 billion FY 2025-2029 Capital Plan invests in the resources and infrastructure for affordability, public health and safety, youth and families, climate and greenspace, exceptional city services and equity and opportunity throughout our neighborhoods.

This fiscally responsible budget will ensure the City is prepared for economic uncertainties, while maintaining a well-resourced government that is prepared to respond to the needs of Boston.

The FY25 Operating Budget and FY25-FY29 Capital Plan are supported by $551.7 million in federal American Rescue Plan Act (ARPA) funds.

For more information, please visit the link below.

Projects

Team

Michelle Wu

Ashley Groffenberger

Tim McKenzie

Talk to us

Have questions? Reach out to us directly.